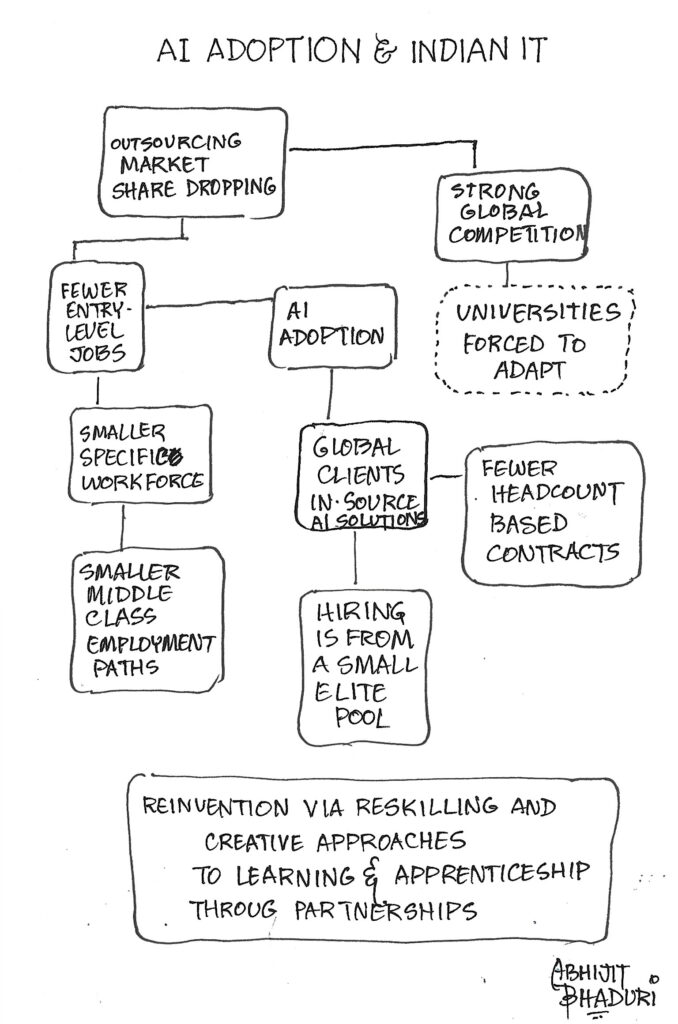

Indian IT outsourcing is under threat as the sector contends with shrinking market share, automation of lower-skill jobs, increased global competition, and a critical need to reinvent both talent pipelines and business models.

The evidence from 2025 shows momentum shifting toward specialized skills, AI-driven operational models, and a requirement for rapid, creative adaptation—challenging the sector’s traditional strengths and requiring urgent, large-scale reinvention to remain relevant. While India’s tech industry generated $284bn in annual revenues, some analysts predicted the sector faced inevitable cutbacks, as clients used AI to trim spending. <Read More>

What does the data reveal

Firms are shifting from traditional headcount billing to project/value-based pricing, creating a challenging transitionary period of 12–18 months of margin pressure. Vietnam, Eastern Europe, and cloud-native platforms are gaining share by offering niche skills, premium security offerings, and price competition.

India’s IT outsourcing market was estimated at $54.1B in 2024, projected to reach $74.1B by 2033 at a 3.2% CAGR, yet its global market share has dropped to about 17–18% as new competitors emerge and clients increase insourcing and automation efforts. Most Indian IT enterprises are integrating AI into business processes and spending $3.5B on cybersecurity, with rapid upskilling in demand for AI, data analytics, and cloud tech. So what is missing?

What Must the CHRO Do

Launch intensive 3–6 month bootcamps to fast-track reskilling in AI, machine learning, cybersecurity, and cloud across the workforce, using micro-credential platforms and partnerships with edtech providers like UpGrad-Enterprise

I spoke the CEO of UpGrad here is the interview

Introduce flexible work arrangements, competitive benefits, and digital mental health support to combat attrition—India faces stubbornly high turnover and talent poaching in 2025.

Position the company as an AI, automation, and sustainability leader to attract next-gen talent.

Deploy skill-based hiring and internal talent marketplaces to mobilize employees into higher-value roles, overcoming legacy job-title silos.

Foster “lab” environments where cross-functional teams can prototype, test, and scale digital offerings, incentivizing creativity and risk-taking.

The Next 12 Months

Pivot to Value-Based Contracts: Shift go-to-market and sales models from legacy headcount billing to innovation- and outcome-based pricing, even if this means a temporary dip in operating margins.

Build Global/Niche Partnerships: Acquire or partner with innovative startups in Europe and Asia to co-deliver AI, quantum, and cybersecurity solutions, expanding the addressable market and alleviating skill shortages

The ROI Case for L&D Investment

L&D investment delivers measurable returns in the current market context. Companies investing in comprehensive reskilling programs are positioning themselves to capture the expanding high-value service segments. The shift from traditional outsourcing to specialized AI, cloud, and digital transformation services requires exactly the kind of workforce transformation that strategic L&D enables.

Professional development investments now directly correlate with revenue growth potential. The sector is poised for significant recovery with enhanced focus on specialized skills and strategic investments in workforce upskilling. Companies that invest early in building AI competencies, cloud expertise, and advanced analytics capabilities will dominate the next phase of industry growth.

Implementation Strategy

Outcome-Based Consulting Capabilities – Cultivating business acumen and solution-oriented thinking that aligns with the industry’s shift from headcount-based to value-driven contracts, focusing on measurable client results

AI and Automation Partnership Skills – Building capabilities to complement rather than compete with technology, enabling human-AI collaboration that amplifies productivity and creates new service categories

Cloud and Hybrid Infrastructure Expertise – Developing deep technical competencies in multi-cloud environments where 62% of Indian companies are planning hybrid implementations, positioning teams as strategic infrastructure partners

This AI transformation is no different: with strategic L&D investment, the industry will once again turn disruption into dominance, proving that adaptability and human ingenuity remain India’s greatest competitive advantages.